DeFi's "Crash" is Really a Chrysalis: A New Dawn?

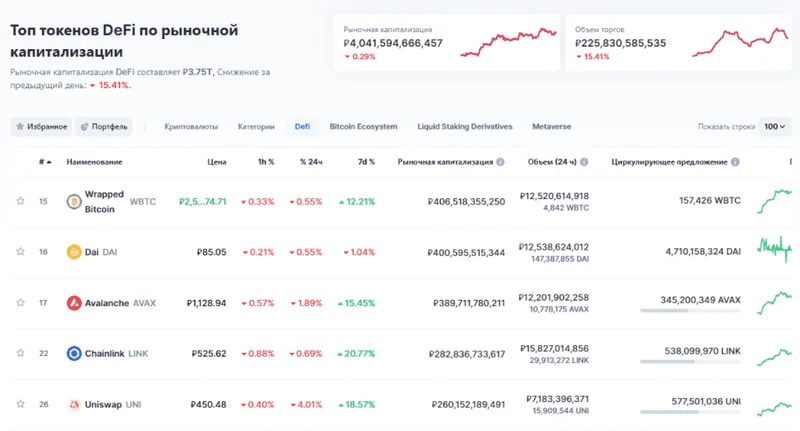

Riding the DeFi Rollercoaster: From Crash to Catalyst Okay, folks, let's talk DeFi. I know, I know—the "October crash" is still sending shivers down some spines. The headlines scream of doom and gloom. We're seeing phrases like "extended sell-off" and "investor flight to safety" dominate the conversation. But here's the thing: crashes, corrections, whatever you want to call 'em, they aren't just endings. They're often *beginnings*. A chance to reset, re-evaluate, and, most importantly, *reimagine*. And what I'm seeing in the DeFi space right now? It's not a collapse, it's a chrysalis. Think about it. FalconX's report highlights that only a tiny fraction of leading DeFi tokens are actually *up* year-to-date. Ouch. But dig deeper, and you find a fascinating trend: investors are flocking to projects with solid fundamentals, whether it's buyback programs or unique catalysts. We’re talking about tokens like HYPE and CAKE showing surprising resilience—outperforming even larger market cap names! This isn't just about damage control, it's about a flight to *quality*. It's like, in a storm, you want to be on the ship with the sturdiest hull, right? And here's where it gets really interesting. The valuation landscape is shifting. Certain DeFi subsectors are getting cheaper relative to others. Spot and perpetual decentralized exchanges (DEXes) are seeing their price-to-sales multiples compress. But *some* DEXes, like CRV, RUNE, and CAKE, actually posted *greater* 30-day fees. The protocols that are useful are still being used. That is a huge deal. What does this tell us? It tells us that the market is becoming more discerning. It's rewarding real utility and punishing hype. It’s separating the wheat from the chaff, if you will. It's like the market is saying, "Okay, show me what you *actually* do." This reminds me of the early days of the internet. Remember the dot-com bubble? So much hype, so much overvaluation, so much…nothing. But after the bubble burst, what emerged? Amazon, Google, the companies that actually *delivered* on the promise of the internet. The "October crash" feels similar. It's a painful but necessary correction that's paving the way for the next generation of DeFi. So, what are the biggest opportunities for 2026? I think the FalconX report gives us some clues. * Perpetual DEXes: The outperformance of perps suggests investors believe they'll continue to lead the DEX space. I’m personally very curious about HYPE’s "perps on anything" markets. If they can truly deliver on that promise, *imagine* the possibilities. What if you could trade perpetual contracts on anything from weather patterns to election outcomes? That's the kind of blue-sky thinking that gets me excited! * Fintech Integrations in Lending: Investors are looking for lending platforms that are integrating with the traditional financial world. AAVE's upcoming high-yield savings account and MORPHO's expansion of its Coinbase integration are prime examples. This is about bridging the gap between DeFi and TradFi, making crypto more accessible to the masses. This is the path to true mainstream adoption. * Prediction Markets: I’m seeing record volumes in prediction markets. Prediction markets are primed to grow, as the cheapening in the DEX sector may be warranted on lower growth expectations. DeFi Token Performance & Investor Trends Post-October CrashDeFi's Second Chance: Building a Future We Can Trust

The Human Element: Trust and Responsibility But let's not get carried away. With every technological leap, with every new opportunity, comes a responsibility. DeFi, for all its potential, is still a Wild West. There are risks. There are scams. There are regulatory uncertainties. We need to proceed with caution, with a focus on transparency, security, and ethical development. I saw someone on Reddit put it perfectly: "DeFi is like a superpower. But like any superpower, it can be used for good or evil. It's up to us to choose wisely." I couldn't agree more. And here's where *you* come in. As investors, as developers, as users, *we* have a role to play in shaping the future of DeFi. We need to support projects that are building real value, that are prioritizing security and transparency, and that are committed to ethical development. We need to demand accountability from the platforms we use. We need to educate ourselves and others about the risks and opportunities of DeFi. This isn't just about making money. It's about building a more inclusive, more transparent, and more equitable financial system. It's about empowering individuals and communities. It's about creating a future where everyone has access to the tools they need to thrive. DeFi: Dawn After the Crash So, what's the real takeaway here? The "October crash" wasn't the end of DeFi. It was a wake-up call. It was a chance to clear out the deadwood and build something stronger, something more resilient, something more meaningful. And I, for one, am incredibly excited to see what the future holds. The Future is Being Built Right Now